We have helped Banks "Go Fintech" by Launching DIY, Savings, and Advisory Apps Seamlessly in their Environments

Plug & Play Wealth in a Box to

Embrace the digital transformation of financial advisory with our high-tech and personal touch banking solutions for wealth Management

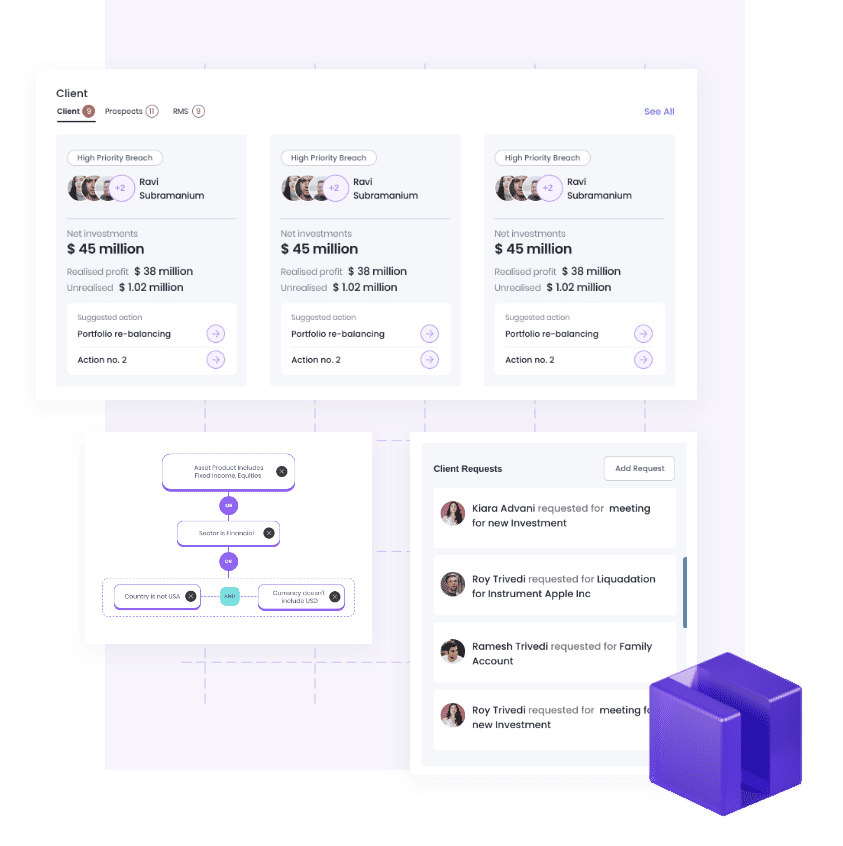

Connect

Use micro apps for financial advice, investing, portfolio analytics, and core modules for data management, back office, and order management to create bespoke wealth and investing apps

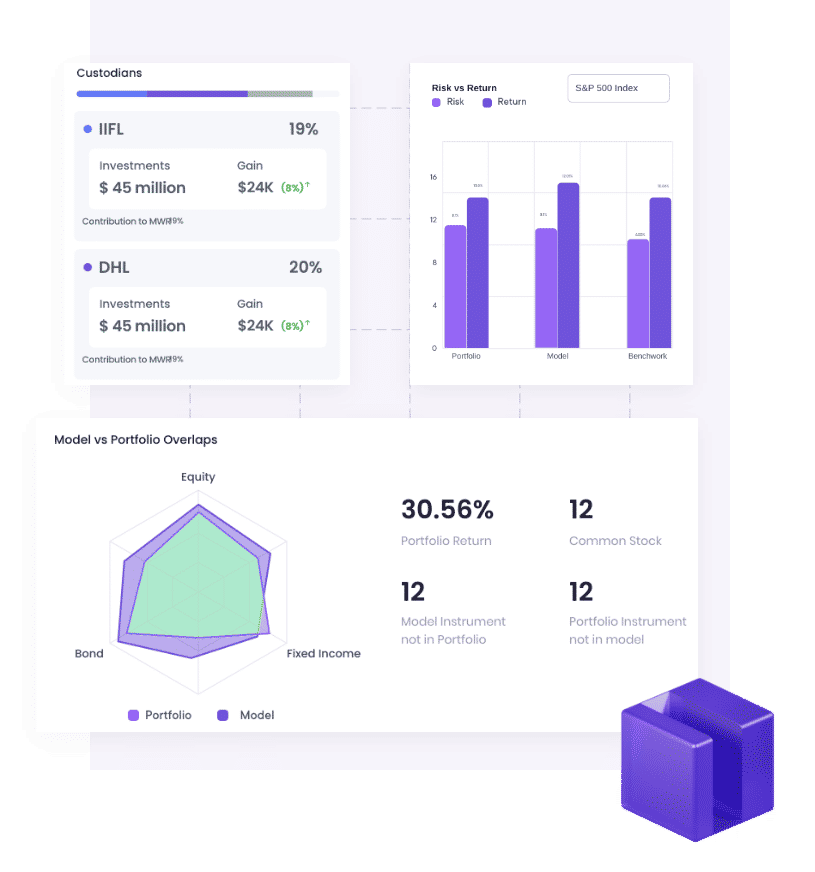

Integrate

A private banking software solutions to accommodate and integrate existing bank apps and provide flexibility to handle any app configuration, irrespective of bank legacy technology for a rapid go-to-market.

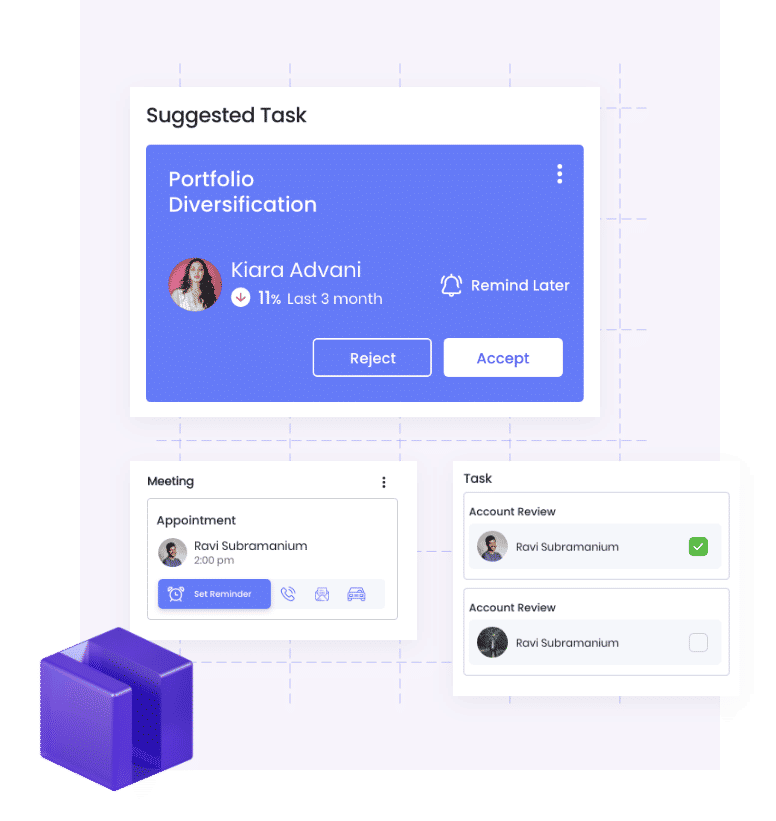

Manage

Experience and agility to achieve digital transformation and production-grade implementation while handling complexity, size, data security, and compliance in banks

Transform

A production-grade infrastructure comprising products, people, and experience to charter banks toward digital transformation

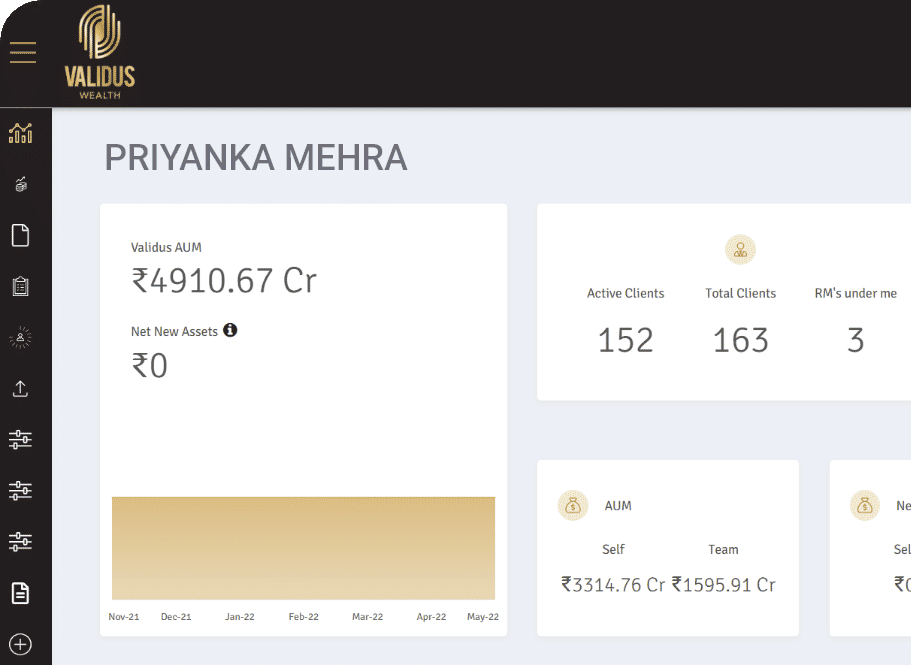

Case Study

Validus Wealth

Evolving with Time

Validus Wealth wanted to further enhance its next generation private client platform by effectively and consistently leveraging the collective capabilities of its 500 talented team members.

View Case Study