Offering a cloud-based wealth management software platform to serve the needs of modern wealth managers covering the front to back-office

Create personalized experience and operational efficiency with our wealth management software

Our wealth management analytics are adept in modernizing the infrastructure by providing integrated or plug n play solutions.

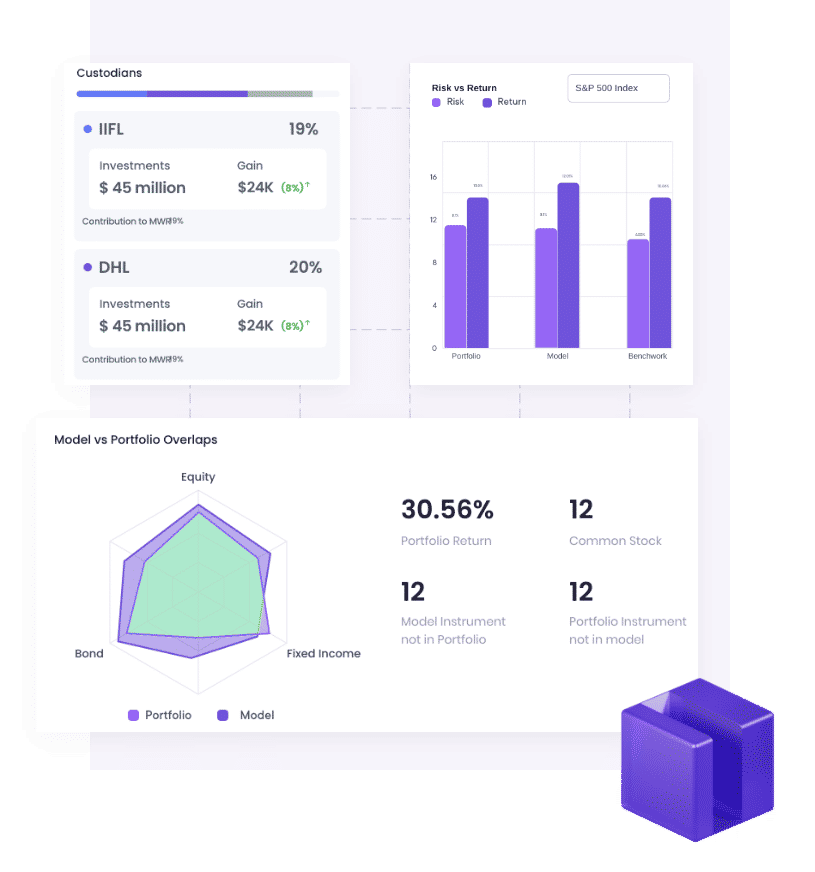

Integrate

Solve the data challenge across multiple data sets, custodians, brokers, currencies and products. Our wealth management platform aggregates and standardizes data and enables insights.

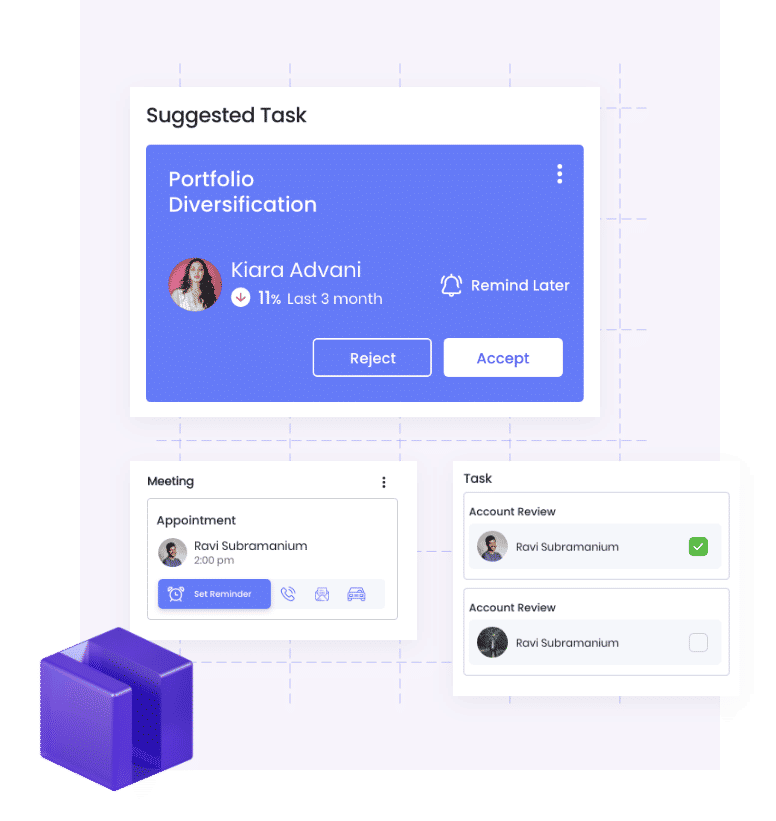

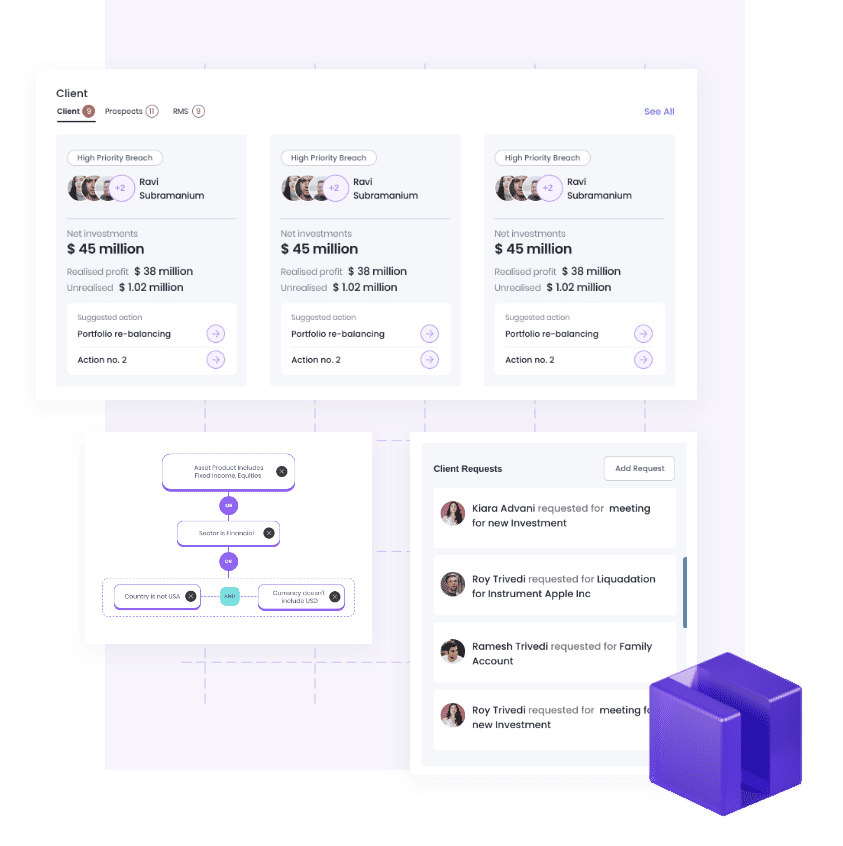

Automate

Automate the advisory flow and process by automating multiple tasks, including investment policy statements (IPS), mandates, model portfolios and portfolio rebalancing.

Collaborate

Our private wealth management software provides one system to connect small teams and high-profile clients.

Engage

Our wealth platform deploys on the cloud for cost effectiveness, with high-levels of security built-in and compliance with multiple jurisdictions covered.

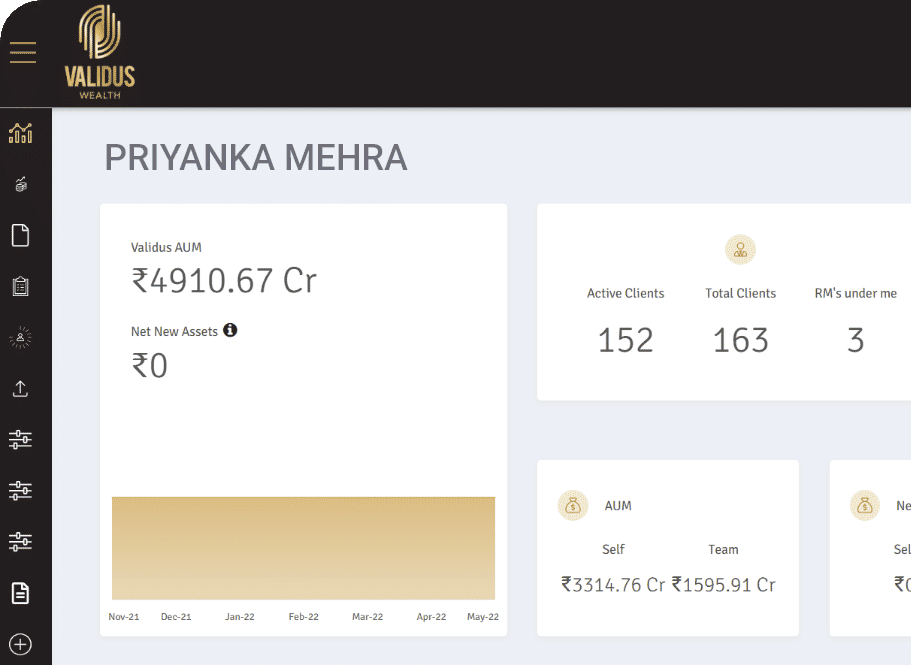

Case Study

Validus Wealth

Evolving with Time

Validus Wealth wanted to further enhance its next generation private client platform by effectively and consistently leveraging the collective capabilities of its 500 talented team members.

View Case Study